INSIGHT HIGHLIGHTS

- In the face of overwhelming battlefield losses, Russia has taken significant escalatory actions for its war in Ukraine, including sham referenda to annex occupied Ukrainian territory, mobilizing at least 300,000 Russian reservists, and threats of a nuclear attack on Ukraine. Russia’s escalation in the war is likely to, at best, delay its defeat, which could make the possibility of the first nuclear attack since World War II more likely.

- In our prior pieces on Ukraine, we highlighted the global asset markets most likely to be affected by Russian aggression, such as energy, FX, and risk-assets like emerging equities markets bearing the brunt. While today, the West has decoupled (to a degree) from its reliance on Russian energy, for the most part, these asset classes are likely to continue to respond to shifts on the battlefield in Ukraine.

- Importantly for investors, with such an unprecedented situation with unpredictable consequences, it will be difficult to navigate markets in any scenario involving an expansion of the Russian war effort, and as such, some investors will likely explore active management strategies such as global macro and multi-strategy hedge funds.

Since late February of this year, Russia has engaged in a brutal war of imperial conquest against Ukraine. In the early days of the war, few military strategists expected Ukraine to hold out this long, facing fierce battles against the world’s second most powerful military. In the face of steep odds though, and with Western backing, Ukraine has turned the tide of war from almost certain defeat, to a grinding stalemate, to now operating on the offensive. Recently, Ukraine has taken the initiative, recapturing in less than a month nearly 10% of previously Russian-occupied territory – land that took Russia months to conquer. In turn, President Vladimir Putin has responded with escalation, calling for a “partial” mobilization of 300,000 troops, “annexing” swathes of Ukrainian territory, and making thinly veiled threats of nuclear retaliation.

Back in March, in our piece “The Ukraine War through the Lens of an Investor”, we discussed the possibilities for Ukraine, the U.S., and the global economy as the war unfolded. While Russian equities and currency markets have stabilized since the immediate aftermath of the invasion, the trends of uncertainty across nearly all asset classes have continued in the wake of shifting battle lines for the war in Ukraine, with volatility remaining high, energy markets remaining stressed, and developed equities markets in an even more severe slump. So with Ukraine’s recent battlefield successes, and Russia’s increasingly bellicose rhetoric towards Ukraine and the West, escalating tensions, and nuclear saber-rattling, how could the war in Ukraine today continue to affect global markets?

AN UPDATE ON THE WAR IN UKRAINE

Last we wrote about the war in Ukraine, in our May piece, “The War in Ukraine and the Looming Global Food Crisis”, the primary concern for the global economy was the severe shortage of agricultural products, such as wheat, sunflower oil, and fertilizer. While shortly thereafter, the United Nations negotiated an agreement to release food stores trapped as a consequence of the fighting, concerns about global agricultural markets persist. At the time, the war was locked in a bloody yet stubborn stalemate, with no perceivable end in sight. While victory, defined as recapturing all of Russian controlled territory in Ukraine, likely remains far off, at the beginning of September, Volodymyr Zelensky announced a counteroffensive against Russian-held land. Initially, the Ukrainians loudly proclaimed their focus in the southern region of Kherson, attacking arms depots deep behind enemy lines in occupied Crimea, in an attempt to concentrate Russian attention in the South and deceive Russia into moving troops from the Northern and Eastern regions of Kharkiv and the Donbas. Shortly thereafter, however, Ukraine conducted a surprise and lightning counteroffensive in Kharkiv, with Russian frontlines almost immediately collapsing in the face of advancing Ukrainian forces. As a result, Ukraine has reclaimed over 10% of the land Russia took months to pacify and control in a matter of weeks.

Tracking the Russian Invasion of Ukraine

Source: New York Times, Oct 2022, “Tracking the Russian Invasion of Ukraine.”

As a result, Russia has responded with a series of escalatory action. In the wake of the Kharkiv advance, Russia has taken three main steps. First, they conducted sham referenda in Russian controlled land, claiming in some places that over 90% of residents in occupied Ukraine supported annexation by the Russian Federation. Second, Putin announced a “partial” mobilization of 300,000 reserve forces in Russia – the first mobilization of reservists in Russia since World War II. As a result of the announcement, many Russian men who have never been a part of the reserves have been called up for duty, and in the chaotic mobilization, hundreds of thousands of men have fled Russia any way they can. By Oct 1st, Ukraine encircled thousands of Russian troops in the city of Lyman, a key supply hub for and access point to the Donbas region (made up of Luhansk and Donetsk), before successfully liberating the town. In turn, senior Russian officials began to explicitly call for the use of low-yield/tactical nuclear weapons to shift the tides of war in Russia’s favor. Thus, this combination of Russia’s actions has amounted to a dangerous escalation of the war, posing both military and economic risks around the world.

THE GLOBAL ECONOMY AND THE WAR IN UKRAINE

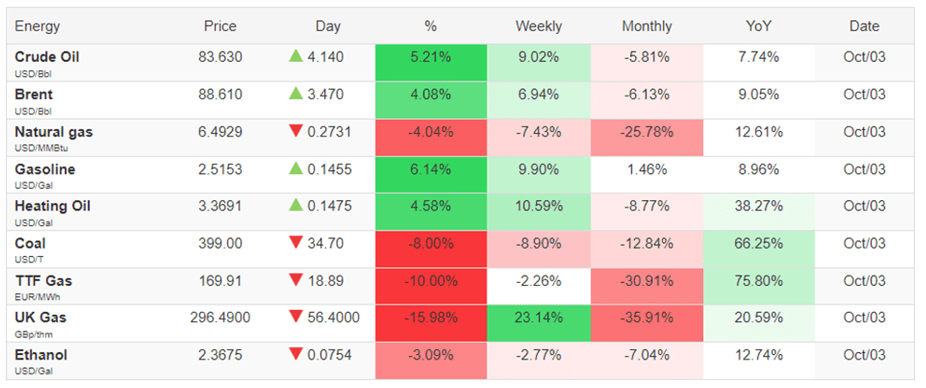

As we discussed back in March, the War in Ukraine has and will continue to affect markets around the world. As we previously discussed in March (“The Ukraine War through the Lens of an Investor”), the main effects we could expect from the war would be: expectations for high volatility across multiple asset classes; underperformance of Russian markets and high beta equity markets, as well as overperformance of defensive stocks; and price rises in energy markets generally.

For the most part, these trends have borne out. While the Bank of Russia took aggressive action in response to unprecedented economic sanctions, the Ruble has now ended the year stronger than it started.

Russian Ruble US Dollar

Source: Trading Economics

Beyond the (largely) unexpected strengthening of the Ruble though, although multiple factors of course have contributed to the current state of the markets (most importantly aggressive tightening by the Fed), we have continued to see extremely high volatility, poor performance of risk equity assets, and a rally across commodities’ markets.

Commodities Prices

Source: Trading Economics

SO WHERE COULD THE WAR IN UKRAINE HEAD, AND WHAT MIGHT INVESTORS FACE ON THE HORIZON

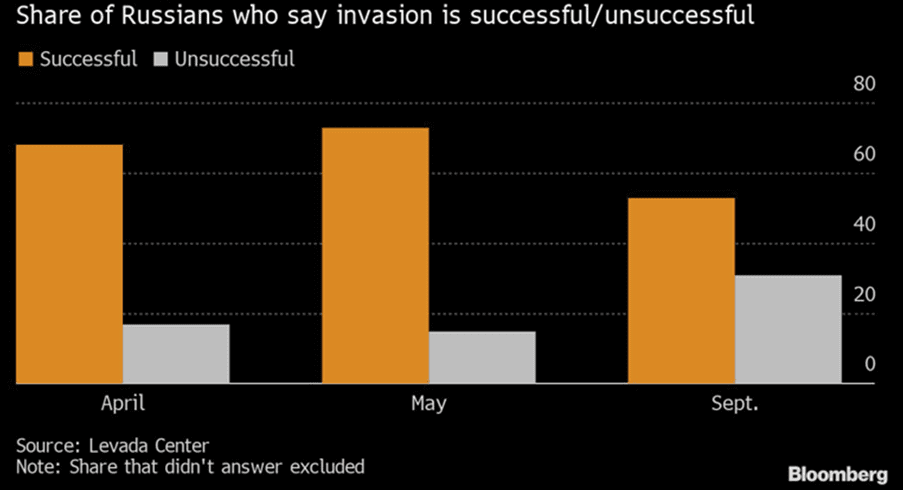

To be frank, the world is facing risks to geopolitical and economic stability it has arguably never faced before. Although Russia’s announcement of the “partial” mobilization called for 300,000 additional troops, reports out of Russia indicate that over a million men could be conscripted under the confidential decree signed by Putin. However, military analysts from both the West and pro-Kremlin commentators indicate skepticism that the fresh troop called for service will have any meaningful effect on Russia’s prospects for victory, with opinions largely centered around the belief that the troops will, at best, delay an inevitable Russian defeat. Moreover, with Russia claiming “legal” control of territory it does not even hold, the potential for continued humiliation of the Kremlin is very real. Already, mobilized Russian troops have deployed to Ukraine and been captured and killed, and malaise about the war amongst the Russian populace has reached unprecedented heights.

Russians Question Success of Ukraine Invasion

Source: MSN, Oct 2022, “Another Defeat in Ukraine Undermines Putin’s ‘Forever’ Goals”

With the heads of Russia’s National Security Council, Chechnya, and the shadowy mercenary company, the Wagner Group, all explicitly threatening and urging the use of tactical low-yield nuclear weapons on the battlefield, coupled with the seeming irreversible nature of Russia’s losses, present severe risks for a global military, and in turn, economic catastrophe.

So what markets could continue to be affected? Prior to the invasion, Russia was largely viewed as the second most powerful military in the world, an illusion that has been shattered by its defeat against a country a third its size. Already, the nuclear saber-rattling is unprecedented since the early days of the Cold War, and thus, further escalation of the war will be uncharted territory in modern history, and certainly for global markets. While NATO has made unspecified threats of a severe response, with the world generally assuming a nuclear strike on Ukraine would provoke a massive conventional military response from the West, ultimately, nobody knows what could happen.

The primary areas we could expect to see an effect is first, in currency markets. Traditionally, the US Dollar serves as a flight-to-quality asset in times of global distress, whether economic or otherwise. Coupled with the Fed’s tightening of rates, a deterioration on the ground that threatens to spill beyond just the war in Ukraine would likely provoke such a response, and already we have seen such moves. At the same time, a resolution in favor of Ukraine and global peace could soften the dollar, as the risks for tension reduce, and the expectation for energy, agriculture, and other supply chain bottlenecks from the war ease up, and reduce inflationary pressures.

Second, as the West, particularly Europe, decouples from its reliance on Russian energy, the effects on commodities such as oil and gas should be less severe than the early days of the war. Already, the European Union has agreed to stop buying Russian crude oil by sea entirely in December, while the major pipelines supplying gas, such as the Russian-owned Nord Stream 1 (recently sabotaged, with Russia as the likely culprit), have largely been shut off. However, with China and India continuing their reliance on cheap Russian energy, we could see turmoil in emerging markets.

Lastly, we should expect to see a deterioration in the values of risk assets globally, with some exceptions from key industries that would benefit from an expanded war effort by the west, such as Defense & Aerospace. Overall though, escalation of the war in Ukraine will almost certainly mean high volatility, and indeed, we have already seen volatility spike back up in response to Russia’s mobilization, nuclear threats, and “annexation” of Ukrainian territory.

United States Stock Market Index

Source: Trading Economics

CONCLUSION

As Russia flails in its effort to stem its losses in Ukraine, the world faces a significant amount of uncertainty both on the battlefield and in the global economy. Since the Cuban Missile Crisis of the ‘60s, the world has not dealt with serious threats of a nation using nuclear weapons. However, as Russia continues to fail to turn things around in its flagging war of imperial conquest in Ukraine, and Putin faces humiliation after humiliation, the risks to the world generally of a new World War, and investors specifically, continue to rise. Ultimately, it is extremely difficult to forecast in this unprecedented situation where the war could go, and how markets could respond, to either a total defeat of or a nuclear strike in Ukraine by Russia. In times like these of global distress and uncertainty, investors often look at active management strategies, such as global macro (funds that seek to trade around geopolitical and macroeconomic events) and multi-strategy funds (which have the flexibility to trade across a wide variety of asset classes to capitalize on unique market events and dislocations). While investors of all stripes face risks in unpredictable scenarios like the one the world faces in Ukraine today, learn how some active managers are positioning themselves in the event of a wide outbreak of war and how it compares against a more traditional passive approach to investing.

Sources:

The New York Times, Oct 2022, “Maps: Tracking the Russian Invasion of Ukraine”

Institute for the Study of War, Oct 2022, “Ukraine Conflict Updates”

Bloomberg, Oct 2022, “Another Defeat in Ukraine Undermines Putin’s ‘Forever’ Goals”

BBC, Sep 2022, “Russia Sanctions: How Can the World Cope Without its Oil & Gas”

CNN, Sep 2022, “US Dollar hits new 20-year high as Russia calls up reservists”

Investors Business Daily, Aug 2022, “The Best Defense Stocks for Today – and the Future”

Wall Street Journal, May 2022, “Dolla Strength Builds as Ukraine War Deepens”

See the institutional third-party private market and hedge funds listed on our platform.

For financial advisors only.

IMPORTANT DISCLOSURE: This document is intended only for the use of a professional financial advisor; contains information that is privileged and/or confidential; and may not be disseminated or altered. Crystal Capital Partners, LLC (CCP), is an SEC registered investment advisor that provides customized hedge and private equity fund portfolio solutions to investment advisors. Neither the SEC nor any other government securities administrator has endorsed the merits of Crystal’s Website, products, services, materials, and/or any of the information contained therein.

This document is for informational purposes only and is not investment advice or an offer to sell or the solicitation of an offer to buy any interest in any entity or investment vehicle. Any offer to sell or solicitation to invest will only be made through the Offering Documents of one or more investments managed by CCP and will be qualified in its entirety in accordance with all applicable laws. This industry information is an opinion only and should not be relied upon as professional and/or financial advice, nor does it constitute a comprehensive or complete statement of the matters discussed. No representation is being made that any investment will or is likely to achieve profits or losses similar to those shown or described. The performance will vary based on many factors, including, but not limited to, investment strategies, taxes, market conditions, and applicable advisory and other fees and expenses related to investing, including fees imposed by Crystal and the portfolio advisor(s). Not all exposures may be available at all times due to capacity or for other reasons.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. Although the authors believe that the expectations expressed in this document are accurate and reasonable, actual results could be materially different. Information contained herein including data used in the calculation of some estimates and projections comes from certain third parties. Any information provided by third parties has not been independently verified by CCP. Accordingly, neither CCP nor any of its affiliates, or employees will be liable to you or anyone else for any loss or damage from the use of the information contained in this document. Additionally, any projections, predictions, market outlooks and estimates included herein are based upon certain assumptions, including but not limited to the prior experience of the authors and other factors it deems relevant such as current and expected market conditions. Other events which were not taken into account may occur and may significantly affect any projections. Although the authors believe that the expectations expressed in this document are accurate and reasonable, actual results could differ materially from those projected or assumed and such projections are subject to change, and are subject to inherent risks and uncertainties.

These investments carry certain risks as alternative investments are complex, speculative, and illiquid investment vehicles and are not suitable for all investors, see Offering Documents for more information. Please refer to the CCP Terms of Use and all related CCP document disclosures.